With the implementation of a new regulatory framework and a rise in coronavirus cases, China’s economy has experienced a major slowdown lately. Initially coping with the pandemic much better than other countries, China witnessed its slowest rate of growth in July and August 2021. China’s businesses are experiencing a sudden crash in the services sector and factory activity that has been triggered by domestic Covid-19 infections, more expensive raw materials, a decrease in the efficiency of exports, and ongoing campaigns to tackle the decarbonization of the industry.

However, this downturn is not just a result of coronavirus-related factory shutdowns but a massive regulatory crackdown targeting big businesses. Beijing has intensified anti-monopoly supervision in order to prevent disorderly capital expansion. The resultant economic slump is substantial given the fact that China boasts tremendous development potential and is expected to continue contributing one-third of global economic growth in the next decade. As a country of 1.4 billion people, its huge potential consumer demand is no doubt appealing to entrepreneurs. So, what happens in China affects the entirety of the international economy at manifold levels.

There has been a whirlwind of activity surrounding China’s treatment of the private sector. It started with China’s increased scrutiny on e-commerce marketplaces and payment services belonging to the likes of Alibaba, publishing draft rules aimed at preventing monopolistic behavior. Beijing slapped a record $2.75 billion antitrust fine on Alibaba Group Holding Ltd after regulators determined the e-commerce giant had abused its dominant market position for several years. China has announced stricter supervision on overseas listing, setting of a series of targeted action. The Cyberspace Administration of China initiated an investigation into ride hailing giant Didi Chuxing after it raised $4.4 billion in an IPO on the NYSE. This was followed by four other Chinese firms halting their IPOs. Medical data platform LinkDoc, which was expected to raise $211 million on the Nasdaq, pulled the listing.

These actions have all aimed towards reining in the private sector and promoting the concepts of common prosperity and dual circulation. What is noteworthy is that these monopoly laws are not being applied to traditional monopolies in the state-owned sector, but in new areas which saw a boom in Chinese private firms’ involvement, such as the technology sector and those that utilize massive technology platforms. Apart from technology, other sectors have been impacted as well. A major knock-on effect of the US-China trade war was the introduction of a new set of Chinese data security laws and new compliance regimes, which were in the process of being gradually introduced but were robustly reinforced in the past couple of months. Beijing’s actions have hurt company stocks, and there are now concerns over investor sentiment. With growing apprehensions of wider interventions, particularly targeting large entrepreneurial firms, the impact is starting to be felt on employment and broader consumer confidence. The official non-manufacturing August PMI has dropped to 47.5, a dramatic decrease from July’s 53.3 reading.

Why kill the golden goose?

While the dust has not settled yet and more regulatory changes continue to be announced, the Chinese economy is already starting to slow down. Given the central role of the Chinese private sector in generating growth, employment, productivity, the bulk of innovation and the largest source of taxation revenues, why then is Beijing bent on implementing these measures? While the tight supervision, supposedly over data and national security concerns, has picked up speed since July, the new regulatory framework had in fact been in the pipes since the 19th National Congress of the Communist Party of China (CPC), held in October 2017. Successive developments have deferred the implementation of these policy changes, such as the US-China trade war that caused economic pain on both sides, leading to diversion of trade flows away from both countries.

As phase one of the trade war showed signs of cessation, the Covid-19 virus outbreak disrupted economies in 2020, with global supply chains affected well into 2021. The trade war exposed Chinese vulnerabilities to US-controlled global supply chains, particularly apparent in wireless communication equipment, printed circuit assemblies and semiconductors. Chinese firms also faced increased difficulties accessing overseas markets and sourcing key components. These developments have in fact reinforced Xi’s plans to implement efforts to decouple the Chinese economy from the US, as confirmed by the 14th Five-Year Plan.

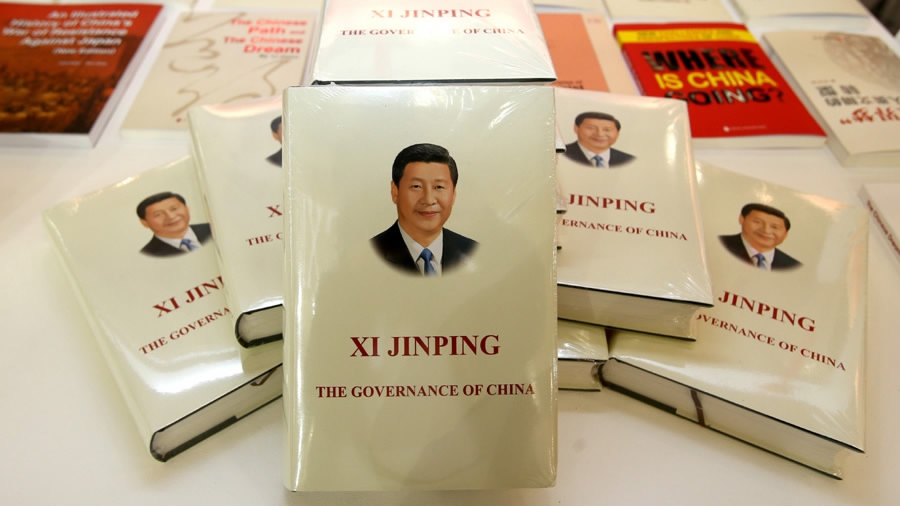

Under Xi Jinping, China will undertake what is being described as “new development concept” to correct the contradiction of unequal relations that resulted from an era of rapid reform and opening since the 1980s. Under Deng Xiaoping’s design, economic development unleashed productive forces, putting aside Mao’s political agenda of class struggle. Xi’s changes in industrial policy is an attempt to rectify the imbalances and inadequacies of the previous models. Under the rubric “new development concept”, an entire series of other policy directions are being set, but in the main the concept stresses the greater role of the Party and the State over the private sector. Common prosperity, income redistribution, national self-reliance, dual circulation economy, data security and environmental policy intervention are all being focused on, with a what appears to be a genuine intervention for the welfare of the common working-class people.

Messages sent by world leaders may have been heard. Many have been outspoken in their criticism of China’s repression at home and aggressive wave of Chinese takeovers of critical infrastructure, from ports to power grids, abroad. In addressing common prosperity as a priority, the new development concept seems to be an attempt to address this blow to China’s reputation. The goal is to nurture inclusive development with strong domestic market, with an emphasis on domestic circulation.

The threat of a great decoupling

The trade war and the Covid-19 pandemic revealed that unwinding tightly integrated global value chains and decoupling US and China’s economies have become a possibility that cannot be ignored. The first phase of decoupling has begun with some international companies re-deploying out of China, moving production to neighboring countries such as Vietnam or back home when costs allow. Some Chinese policymakers have been worried since the 1990s about over-dependence on the US dollar and high-end American technology. China has come to understand the risks of US suppression of Chinese technologies, and its response has been innovation-driven development. The threat of decoupling, as witnessed in American actions against Huawei, has convinced Beijing that large-scale imports of technologies can no longer support long-term economic progress.

The future model of development

China will be shifting to a more qualitative economic growth and ecologically sustainable development centered on greater social equality. The new development concept is being undertaken as a stage in the evolution of China from its socialist revolution, into a period of reform and opening up, and now towards building a modern socialist country. The old model of economic development had caused a widening gap in economic development and living standard among different regions and increasingly there is a sense that it was time to address these shortcomings. Within the CPC, there is an understanding that the country’s economy has now entered a slowing phase, “a painful structural adjustment phase, and a phase of absorbing the adverse effects of previous stimulus policies” and the Party’s governance foundation states “realizing common prosperity” as the major economic goal.

The new regulatory policies will certainly bring a period of uncertainty for China. But while they will contribute to slow down growth in the near future, their implementation is seen as critical to address challenges such as income gap, resource intensive manufacturing, the need for industrial upgrading and technological innovation, and China’s contentious trade relations with other countries. China is at an inflection point in its economic policies and consolidation at home is the clear priority.

Picture credits: CGTN

Be First to Comment