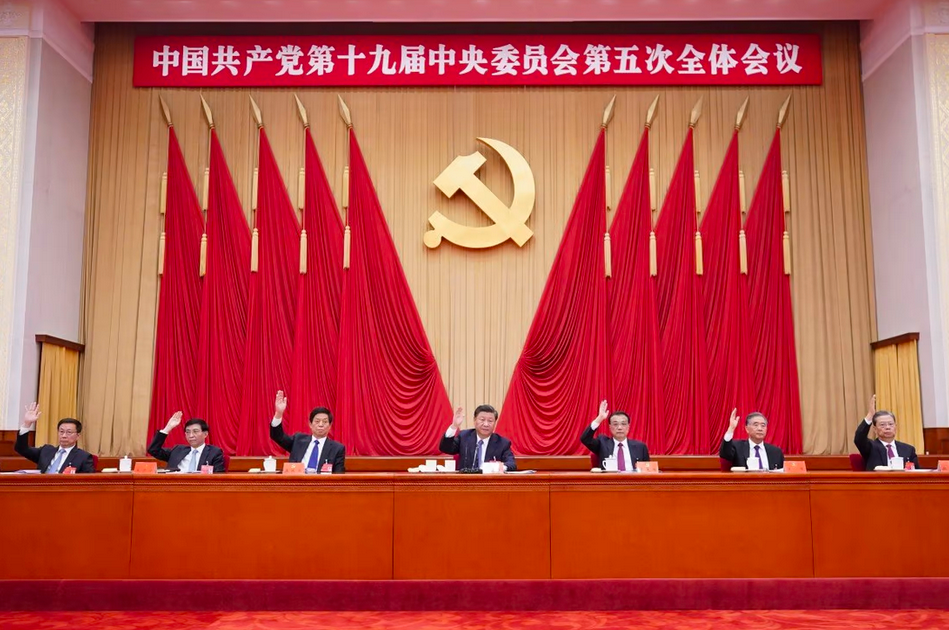

With much of the world’s attention being focussed on the 2021 United Nations Climate Change Conference (COP26) in Glasgow, not much is being said about China’s absence. With Xi Jinping not attending, does it mean that China is not committed to reducing its emissions or is it an indication that something much more profound is happening? Is there a greater significance to the CPC’s 6th Plenum taking place between the 8th and 11th of November?

Typical of China’s use of deflection, supporters of Xi Jinping argue that nothing untoward should be read into Xi’s absence from Glasgow. They distract by pointing out that he has not left the country for up to two years. However, what they do miss in their assessment are two important dimensions. Firstly, they ignore that other global leaders have confined their movements due to Covid-19, but this summit is different in that Glasgow is the first opportunity for all leaders to have face to face meetings on an issue that impacts the global economy. Secondly, supporters of Xi and China continually posit the notion that China is the global leader in “going green”. This begs the question, if this is true, why would he give up such an opportunity to showcase China’s ‘sharing a common human destiny” philosophical framework under the climate change umbrella?

Getting back to the conundrum – why is Xi Jinping not attending a global summit that has international importance?

The answer lies in the increasing importance of the CPC’s 6th Plenum in November. Essentially there are two intertwined themes emerging, both of which will have a significant impact on global trade and security. The two themes or subplots to the narratives are: socio-economic development and Xi Jinping’s leadership. These two themes are not suggesting that there is a questioning of the existence of the Party but is more around how the Party delivers “socialism with Chinese characteristics”. What policy framework is best suited and who should be leading the implementation of these policies?

The 6th Plenum is taking on the shape of the 3rd Plenum in 1978, in which Deng Xiaoping ascended to power and effectively changed the Party direction by undoing much of what Mao had done in the name of the Party. The 6th Plenum has all those characteristics in that significant policy shifts must be made with regards economic and monetary policy, whilst simultaneously having to deal with increasing tensions within the Party.

Supporters of Xi argue that the review of the leadership is typical and normal during a Plenum. Once again, there are a number of critical differences this time as the internal debate within the Party leading up to the Plenum resembles that which took place in 1978 as Deng Xiaoping introduced the policy approach “seeking truth based on facts”. This plenum will have significant ramifications in that it will either cement Xi Jinping as leader life or there will be a soft coup in which Xi Jinping will step down. Either way, business and trade will need to be flexible and be able to adjust.

Why is it likely that a “soft coup is underway”?

This idea has been building since 2017, starting with Xi initiating a crackdown on the Politburo’s executive, reducing it from 9 to 7 members. In the process he silenced his opponents and detractors under the guise of anti-corruption, broadly defined as anything that harmed the integrity and solidarity of the Party. This was done via arrests and executions. Internal dissatisfaction with Xi’s leadership was further exacerbated by the 2018 decision to allow Xi’s leadership to extend beyond two terms.

Former political insiders, such as Chellaney and Roger Garside have formulated the view that this 2018 revision of the leadership terms was an important catalyst for those within the Party executive to question whether the Party was reverting to the Mao style history, in a sense reversing the 1978 Plenums assessment that the Cultural Revolution had been a mistake. This is an important inflection point as the Party looks to create a blueprint to deliver on its new century theme of a common prosperity. Deng Xiaoping introduced trickle down wealth creation, but this has created a significant wealth gap, with China’s Gini coefficient being a lowly 38.5.

Adding fuel to the fire is the significant slowdown of the China’s economic growth, anticipated to be slow to 4.9%. This slowdown may be accelerated as China experiences significant power shortages creates havoc with the manufacturing sector. It is also getting much attention on social media, which increasingly is becoming more vocal with regards the Evergrande property failure as well as Hong Kong-based Fantasia property group. Questions are being asked by locals whether these major employers are being allowed to fail because they are seen as a threat to the Party, just as Jack Ma and technology companies are.

As a source within Beijing states, ”here on the ground in Beijing, the common people are generally happy about the progress and improvement in their living conditions. However, cracks are starting to emerge, and local social media cannot be silenced everywhere, all the time and in time. The real estate crisis is a scar which can be a big problem moving forward, the carbon neutrality policy may bump into some production and heating hurdles, the local governments lack of funding may start biting and the social net may not see the improvements which the people are expecting”.

Senior and influential leaders within the Party are agitating for change. Several internal factions have emerged. with Premier Li Keqiang and Wang Yang of the politburo lead one such faction, but it is the Shanghai faction that is causing the most concern for Xi. The main protagonists within the Shanghai faction are Zeng Qinghong and Wang Qishan. Zeng Qinghong is of interest because of his family connections with the Hong Kong based Fantasia property group that is facing financial collapse.

Xi Jinping admitted in a press briefing on October 2, that there is indeed a power struggle. The briefing went on to clearly identify that the “disruptor” was the Shanghai faction led by Jiang Zemin. A consequence of this has been the arrest of Sun Lijing, the Public Security Vice Minister, to “eradicate the poisonous influence” of Sun and others.

There are several EU diplomats sensing this change in the wind and expressing the view that the next 12 months will see China go through a speedy rejuvenation. But what they caution is that this may well be under a new leadership. The question to be answered is what style of new leadership will emerge. Further indications of a potential soft leadership change or coup gaining momentum is the recent EU delegation going to Taipei. Significantly, this seven-member group is from the EU’s special committee on foreign interference. It is also noteworthy that this has all happened despite China’s threats of “dire consequences” should this delegation proceed with its meeting with the Taiwanese political leadership.

All indications are that the 6th Plenum will perhaps be even more interesting to follow than the “electoral” one planned for 2022, as the leadership die would have been cast.

The 6th Plenum issues that will affect business

There are several policy issues that are scheduled for debate. All have a direct bearing as to how the Party will deliver its second anniversary common prosperity policy direction that will shape the Party for the next 100 years. All will have a direct bearing on how trade and business will engage with China’s economy.

The first debate will be around the One China, Two Systems policy framework, particularly to its applicability to the new century. Central to this debate will be Taiwan. It has been argued that Xi is using the Mao-based One China policy to stir up nationalistic fervour that facilitated Mao and the CPC to grasp power. With sustained military pressure on Taiwan, 149 violations of its Air Defense Identification Zone (ADIZ) in the first four days of October alone, there has also been political and economic coercion of those seen to be recognising Taiwan as independent.

These incursions do not line up with the November China Department of Defence report referring to PRC’s armed forces 2027 modernisation plan. This is a plan that would provide China with more credible military options for Taiwan. What purpose do these incursions play?

Companies that have supply chains dependent on Taiwan, will need to develop contingency plans to secure services and products should there be some form of intervention by China. These should be executable at short notice as there is potential for Xi to fully invoke the Art of War’s mantra that you can only win through the barrel of a gun as he tries to shore up his leadership. Fortunately, there are factions within the Party that do not subscribe to this view and could be the ultimate catalyst for leadership change.

There will also be debate and discussion around the recently introduced Dual-Circulation policy. Xi has been masterful in how he has taken this standard macro-economic policy and spun it into an initiative that appeals to nationalism. Whilst the policy looks to boost China’s self sufficiency as well as to address the middle-income trap, it needs to be seen within the context of the country’s debt. Currently China has reached maximum debt capacity and has to re-balance from investment in the economy to growth through domestic consumption and at time of slower growth. Fuelling the problem is that between 2010 and 2020, China’s GDP doubled but its total debt tripled to $43 trillion – 280% of GDP. Furthermore, there is a structural debt imbalance. Whilst commentators highlight that China’s foreign debt ratio to GDP is at a lowly 15%, the total debt ratio is now approaching 300%. Further increases in domestic debt will make the dual circulation policy impossible.

This structural imbalance means that keeping the two revenue circulations separate will become increasingly difficult.

To make this work, China will need access to greater international finance, with some indications that direct investment into China is slowing. For this to happen, China would need to not just open its economy, but also make it more transparent. In recent weeks Xi has seemingly adopted this approach as others have impressed on him that the current “wolf warrior” approach has not worked at the international level. Another approach could see the introduction of onerous import, foreign exchange, and domestic consumption controls. Business needs to be monitoring this space intently as it may well present opportunities for investment but there are also significant threats.

The final policy decision will revolve around the debate of the 2018 initiated “Community of Shared Future”, now embodied in the Chinese Constitution. This has been integrated into both the Digital Silk Road and the Belt & Road Initiative (BRI). Included in this debate will be what is meant by “socialism with Chinese characteristics” and the role Deng Xiaoping played in adopting market economics to grow wealth and the middle class. Central to this discussion will be whether China needs to engage in further economic growth to realise an egalitarian society, and how best to achieve economic growth.

There will no doubt be heated discussion around the role of private property ownership, state-owned enterprises (SOEs) and the public sector. Encompassed in this is the use of higher progressive individual, inheritance, and corporate taxes to share wealth. This is a discussion that Xi has been avoiding as the outcomes could have devastating effects on innovation and development within China. Speaking to locals in Shanghai there is already a feeling of dissent shown through the passive “lying flat” protest. It comes as no surprise, therefore, that a new tax policy document has been sitting with Xi since 2018.

There is one reality that business needs to have. The CPC will not collapse. The Party has reached an important infection point and the 6th Plenum will address where they want to take the country in the next decade as they enter the new century of their existence. All indications are that the Party, after a review of its key policies and leadership during the 6th Plenum will make changes to its current structure. This is in part driven by the younger generation, that has increased access to social media and the West, and that are looking for a more liberal and interconnected society. It is also driven by Party pragmatists that see that elements of the market economy are still needed to create an egalitarian society.

Businesses need to be aware of these changes coming as well as be nimble enough to embrace or adapt to the new China era.

Picture credits: Xinhua / South China Morning Post

Be First to Comment