Versions of this article were originally published on October 13, 2023 by the Policy Center for the New South and The Diplomat. Thank you to the authors for their kind authorisation to re-publish.

This article was co-authored with Xiaofeng WANG. Currently based in Washington, D.C., Xiaofeng was previously a business and politics reporter based in Beijing. She once served as a Hubert H. Humphrey fellow as part of the Fulbright scholarship program at Arizona State University and short-term senior fellow in New America. Her work has been featured in several prominent outlets and organizations, including the Brookings Institute, Stanford Social Innovation Review, The Diplomat, and more.

Introduction

Argentina’s potential move towards dollarization, championed by Javier Milei, the unexpected front-runner in the elections scheduled for October 22, would signify a profound transformation involving the abandonment of the peso and the dissolution of the central bank. This potential move, along with Milei’s anti-China rhetoric, raises a significant yet often overlooked issue concerning the continuation of the currency swap line established between the Central Bank of Argentina (BCRA) and the People’s Bank of China (PBOC). This swap line was recently used to avoid a default on Argentina’s repayment to the International Monetary Fund (IMF).

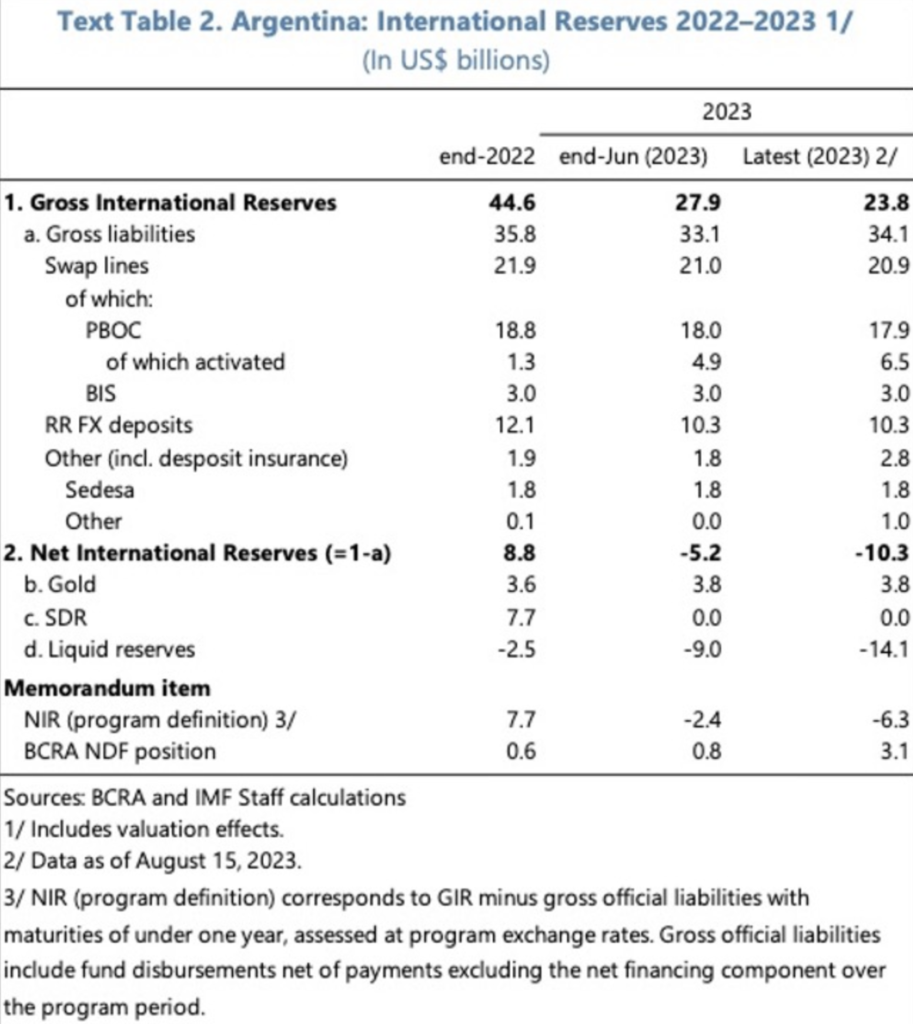

In 2014, a version of the China-Argentina bilateral swap line (BSL) was put in place as part of a comprehensive strategic partnership between the two countries. Over time, it has become a crucial source of financial support for Argentina when it faces cash shortages. The 2023 IMF Staff Country Report on Argentina highlighted that the BSL accounts for a significant portion of the BCRA’s international reserves, and plays a vital role in offering short-term liquidity support to help Argentina service its external debt obligations and finance imports. The PBOC recently agreed to the BCRA’s request for another three-year term, and doubled the accessible portion of the swap to nearly $10 billion, signifying a strengthened bilateral partnership.

Source: IMF

However, if Javier Milei emerge as the winner on October 22, there would be considerable uncertainty around the continuation of the swap line with China, and Argentina’s ability to repay the IMF in the event of dollarization. This radical shift potentially signals a reorientation of Argentina’s economic strategies, which could reverberate through its trade dynamics and diplomatic relations with China.

The Evolution of the China-Argentina BSL: An Asymmetric ‘Tango’

Bilateral currency swap lines, established by two monetary authorities, offer mutual insurance during periods of financial instability by enabling the exchange of currencies at predetermined interest rates and exchange rates (Denbee et al, 2016). Starting in 2008, China began to build a global network of central bank swap lines, rapidly gaining momentum because of its strong commitment to renminbi internationalization and the growing interest of emerging markets in seeking alternative sources of financing (Tran, 2022; Zhang, 2015). By May 2023, China had entered into bilateral currency swap agreements with over 40 countries and regions, with a total value exceeding RMB 4 trillion ($582.3 billion).

Among China’s various swap agreements with different countries, its arrangement with Argentina stands out for its longevity and extensive utilization. The BCRA was among the early adopters of swap agreements with China, and it remains one of the few institutions that have extensively accessed the PBOC swap line to address liquidity stresses.

A brief history provides context. The first China-Argentina BSL, valued at RMB 70 billion (approximately US$11 billion), was signed in 2009 for a three-year term. Although it was the largest financial agreement between China and Latin American countries at the time, the original arrangement was never activated before it was amended in 2014 by a renewed deal with significant improvements in flexibility, functionality, and affordability. The 2015 supplementary agreement allowed the BCRA to convert up to RMB 20 billion from the swap line into U.S. dollars. This transformation elevated it from primarily serving as a local currency trade-settlement mechanism into the lender of last resort to finance fiscal debt.

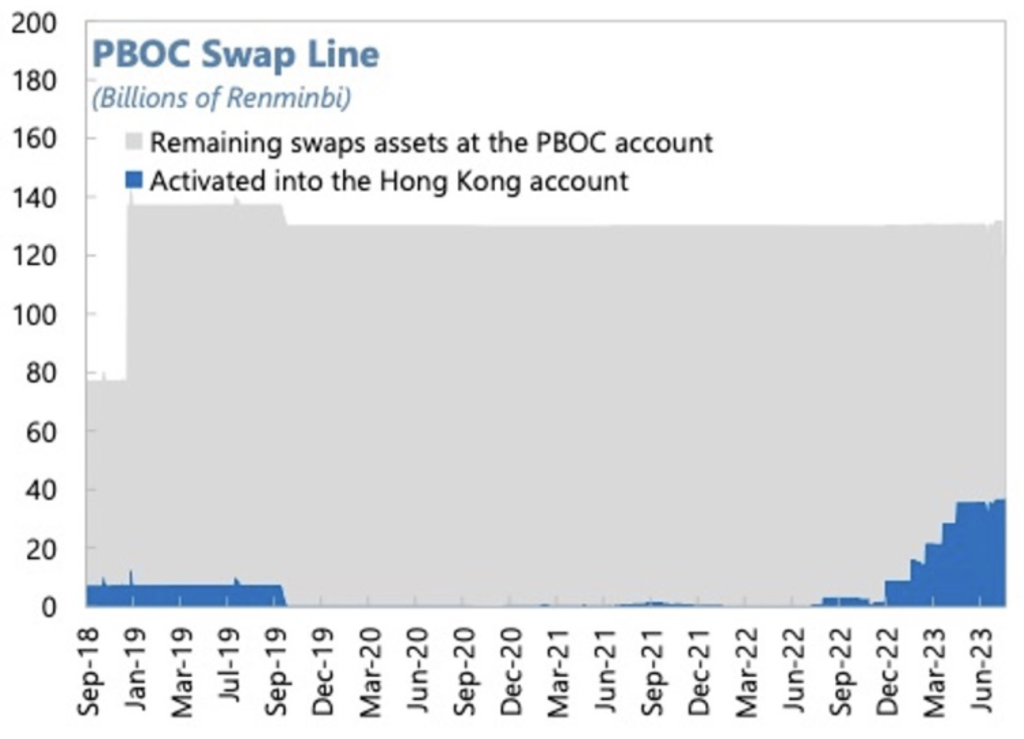

Although both parties have an equal right to activate the swap line as needed, the dynamic in the China-Argentina BSL is characterized by asymmetric dependence. As the U.S. typically acts as the lender in such agreements, China’s substantial foreign reserves and strong economic fundamentals also empower it to take on the lender’s role, giving it the authority to approve or reject the BCRA’s request for a swap draw. When the need for liquidity arises, the BCRA would initiate a request, and, on approval from the PBOC, RMB would be deposited into the BCRA’s account at the PBOC. In return, the PBOC would receive an equivalent amount of peso as collateral. At the end of the repayment period, usually around one year, the BCRA would pay back the RMB at a predetermined interest rate, reported to be between 600 to 700 basis points.

Since its activation in 2014 to counter severe currency depreciation, Argentina has consistently turned to the PBOC swap line, and its dependence has steadily increased. According to Vincient Arnold, the BCRA maintained outstanding balances under the swap arrangement ranging from $2.6 billion to $20.5 billion between 2014 and 2021. During this period, the ratio of swap obligations to foreign reserve obligations increased from 8.2% to 51.6%.

Over time, this trend has intensified as Argentina’s economy has descended further into turmoil. During the tenure of then-President Mauricio Macri’s right-wing administration in 2018, there was an attempt to reduce reliance on the PBOC swap line by seeking funding from the IMF. However, the $57 billion record bailout from the IMF failed to resolve Argentina’s economic troubles.

By 2022, Argentina’s deteriorating economic situation had pushed it to the brink of default with the IMF. Even though a last-minute deal on debt restructuring was reached in 2022, Argentina continued to struggle to meet its regular payment obligations. Starting in 2023, Argentina, for the very first time, turned to the PBOC swap line to repay the IMF. According to the IMF Staff Country Report, as of mid-August, Argentina had drawn $2.7 billion from the PBOC swap line (including a bridge loan) twice in the span of 30 days to avert default with the IMF. Beyond debt financing, an additional $2.7 billion in swap draws was allocated for financing imports ($1.8 billion) after the peso suffered a selloff, and for servicing debt obligations to bondholders ($0.9 billion).

Source: IMF

The Future of the China-Argentina BSL: Tango Tangles?

The recent repayments by Buenos Aires to finance its IMF debt highlighted Argentina’s growing dependence on the PBOC swap line. The potential replacement of the China-friendly incumbent, Alberto Fernández, by the Trump-like Javier Milei introduces uncertainties about whether Argentina will continue making payments to the IMF in the future, and whether it will need—and will be able—to utilize the swap line once more.

The swap line with China is believed currently to hold the key to avoiding Argentina’s IMF default, according to Matthew Mingey, a senior analyst with Rhodium Group. Milei’s proposal to abolish the central bank presents a distinct challenge to it. This is because the swap line was established through bilateral agreements involving the central banks and currencies of both countries. The BCRA is the sole eligible party on Argentina’s side to manage its bilateral swap line with its Chinese counterpart. If the BCRA and the peso were to be abolished, the swap line would become essentially meaningless. Hence, a myriad of crucial questions come to the forefront. Who would step into the BCRA’s shoes when it comes to managing the unwinding of the swap line with China? Dollarization won’t occur overnight. Would China continue to provide access to swap lines for Argentina, considering that the PBOC swap line might remain in place for a transitional period?

Milei’s chief dollarization strategist has suggested the establishment of a dedicated fund in an Organization for Economic Co-operation and Development jurisdiction as a means to take over the responsibilities of the BCRA in managing the country’s reserves and dealing with short-term peso debt. However, no clear plan has so far been laid out for managing the bilateral financial agreements the current administration has entered into, including the swap agreement with China. While the primary focus of this specialized fund is to repay the $26 billion of debt instruments held by commercial banks (Tobias and Doll, 2023), there hasn’t been any discussion about how to address the debt resulting from the currency swap arrangement with China.

On whether China would continue to provide access to swap lines for Argentina, empirical evidence indicates that these agreements often have an asymmetrical nature, giving China a significant upper hand when it comes to deciding when and how to activate, extend, or expand swap lines. This advantage has led some scholars to argue that China strategically utilizes this leverage to either reward or penalize partner countries, based on their alignment with China’s political positions. However, it’s important to note that being a creditor also exposes China to exchange-rate risks related to the borrowed currency. In the case of the swap line with Argentina, China provides liquidity and, consequently, assumes the credit risk associated with Argentina’s borrowing. If Argentina encounters difficulties in repaying the swap, China could potentially incur losses due to exchange rate risk.

In a less-optimistic scenario, some Chinese scholars have suggested that China may need to take a tougher stance if Milei adopts a more assertive posture towards China, by aligning more closely with the U.S. A Chinese scholar associated with a state-run think tank stated on the condition of anonymity, “China should insist that the new government either tones down its anti-China rhetoric, or else, we should withdraw our funding.”

While an immediate termination of the swap deal may not be imminent, China could opt not to offer further access to the swap line. In such a situation, the primary concern on the Chinese side would revolve around the management of the activated portion of the swap line, which stood at $6.5 billion as of mid-August (IMF Staff Country Report, 2023). Any mishandling of this situation would undoubtedly trigger domestic backlash, particularly amid economic downturns.

Considering China’s past dealings with pro-U.S. administrations, including those of Mauricio Macri and Jair Bolsonaro, it’s likely that China would adopt a more pragmatic and cautious approach to settle the swap line with Argentina. In 2018, when Argentina faced economic challenges similar to those it faces today, Macri chose not to activate the PBOC swap line but instead turned to the U.S.-backed IMF, securing a record-breaking $50 billion bailout program.

Surprisingly, China did not respond by freezing the swap line. Instead, China used it as leverage to distance Argentina from its alignment with the U.S. During Xi Jinping’s visit to Buenos Aires in December 2018, an additional RMB 60 billion was added to the original swap line as part of a package of 30 trade and investment bilateral deals. These moves effectively softened Macri’s pro-Washington agenda. Similarly, Bolsonaro’s initially tough stance against China saw a significant shift as China increased its investment commitments to help boost Brazil’s sluggish economy.

It is evident that when politicians who favor closer ties with Washington prioritize business interests and avoid causing political discomfort, Beijing has shown openness to maintain cooperation. This principle could also be applicable to Javier Milei. One key challenge associated with his dollarization plan is the implementation phase. The central bank must exchange all of its liabilities in domestic currency for U.S. dollars (Canuto and Carranza, 2022). If Milei cannot secure sufficient financial resources from multilateral institutions, he may reevaluate the potential for accessing a swap line with China, or explore alternative avenues for securing financing from China.

It is estimated that Milei’s proposal for dollarization would cost the already cash-strapped Argentine economy $40 billion. Milei and his team are now exploring various options to raise these funds but have yet to provide a convincing plan. Possible solutions include sourcing funds from repatriating assets held abroad or reintegrating unreported cash into the financial system. Additionally, the special-purpose fund mentioned earlier would serve as collateral for potential borrowing. This fund would consist of treasury bonds, debt from the public pension fund, and shares in the state oil company.

However, skeptics argue that Argentina has been excluded from the international bond market since its default in 2020, with few investors willing to engage in any transactions involving Argentine bond (Squires, 2022). As a result, Argentina’s current external financing options are almost limited to China and Qatar, the other bilateral lender helping Argentina repay the IMF.

Milei’s inability to secure such a substantial amount of funding through market channels would limit his ambition to dollarize the country’s economy and prompt him to consider a path similar to his predecessors by seeking funding from China. If Milei moderates his China policy, China could potentially continue financing a dollarized Argentina, regardless of whether a swap line is in place. In this context, there are parallels with China’s efforts to cultivate strong ties, both in finance and trade terms, with dollarized economies such as Ecuador and El Salvador.

The lack of a swap line did not discourage China from lending money to dollarized Ecuador. In total, Ecuador took about $18 billion in loans from China, mainly during the presidency of Rafael Correa, an anti-U.S. leftist. These funds were obtained through Chinese state-owned banks for various infrastructure projects, or through prepayment agreements (Horn et al, 2023), in which Chinese oil companies provided upfront cash in exchange for future oil sales. When pro-American conservative Guillermo Lasso assumed office, despite his prior criticisms of Chinese loans, China extended oil-backed loans and agreed to restructure $4.4 billion of Ecuador’s debt, resulting in the country saving $1 billion from 2022 to 2025.

In the case of El Salvador, its vice-president, Félix Ulloa, said that China had offered to acquire the country’s $21bn in foreign debt. Nevertheless, the spokesperson for the Chinese Foreign Ministry declined to provide any official response to this claim.

China also appears undeterred in strengthening trade ties with dollarized economies. Earlier in 2023, Lasso successfully negotiated a free trade agreement with China, expected to expand export opportunities by nearly $1 billion. According to the United Nations COMTRADE database, Ecuador’s trade data with China indicates that its exports steadily increased from around $500 million in 2013 to $4.07 billion in 2021, despite the lack of local currency settlement facilitation.

In contrast, Argentina’s exports to China fluctuated between 2015 and 2022, and it maintains a trade deficit with China, despite its swap line doubling since its initiation. Moreover, research has suggested that the trade effects on currency swap agreement partner countries not participating in the Belt and Road initiatives are less pronounced.

When we compare Ecuador and Argentina, it becomes clear that the trade relations between China and Argentina hold greater significance in terms of both quantity and geopolitical impact. Argentina’s exports to China, which is its second-largest buyer, are a crucial source of consistent revenue. This income is vital for replenishing the country’s depleted reserves and achieving the financial goals agreed with the IMF.

Furthermore, maintaining stable trade relations with Argentina aligns with China’s strategic objectives, particularly in securing essential resources, including lithium and soybeans, from countries that are not closely aligned with the U.S. Disrupting these trade ties would not be in the best interest of either party. In this context, it appears that discontinuing the swap line between China and Argentina would have limited repercussions on their overall bilateral trade relations.

Conclusion

“It takes two to tango,” the saying goes. As dollarization unfolds in Argentina, the destiny of its bilateral swap line with China is entangled with the broader economic and policy dynamics between China and Argentina. Milei’s challenges in addressing Argentina’s multifaceted problems, coupled with China’s interest in maintaining a stable bilateral relationship, suggest that pragmatic considerations may ultimately determine the course ahead.

Milei, if elected, will face mounting challenges both within and beyond Argentina’s borders. The nation teeters on the precipice of an even deeper recession, as inflation skyrockets above 100% and international reserves dwindle. The IMF faces mounting pressure to adopt a tougher stance on Argentina, pushing it to stick to its commitment to economic targets and debt obligations. Yet, it is a daunting task to envision how Milei will navigate these economic and financial hurdles, while simultaneously attracting sufficient funding for his dollarization strategy.

This challenging scenario may ultimately prompt Milei to reevaluate Argentina’s access to the swap line with China as he pursues the path of dollarization. Meanwhile, a disruptive bilateral relationship with Argentina isn’t in China’s best interest. China should be able to find a pragmatic resolution with Argentina to address the issues surrounding the bilateral swap line. This doesn’t necessarily rule out the possibility of Argentina continuing to access the swap line for a certain period. In this intricate economic diplomacy, pragmatism is likely to guide the steps of both nations as they navigate these complex challenges.

Bibliography

- Arnold, Vincient. (2023). “China: Central Bank Swaps to Argentina, 2014.” Journal of Financial Crises, Vol. 5, Issue 1, 158-188.

- Canuto, Otaviano. (2023). “Rising Use of Local Currencies in Cross-Border Payments.” Policy Center for the New South.

- Canuto, Otaviano, and Sebastian Carranza. (2022). “Dollarization of Argentina: Revival of a Zombie Idea.” Policy Center for the New South.

- China’s Foreign Ministry. (November 2022). Routine Press Conference of China’s Foreign Ministry hosted by spokesperson [Translation: 2022年11月8日外交部发言人赵立坚主持例行记者会].

- Denbee, Edd, Carsten Jung, and Francesco Paternò. (February 2016). “Stitching Together the Global Financial Safety Net.” Bank of England Financial Stability Paper No. 36.

- Global Times. (June 2023). Central banks of China, Argentina renew bilateral currency swap deal.

- Horn, Sebastian, Bradley C Parks, Carmen M Reinhart, and Christoph Trebesch. (March 2023). “China as an International Lender of Last Resort.” Kiel Institute Working Paper No. 2244.

- International Monetary Fund (IMF). (August 2023). Argentina: Fifth and Sixth Reviews Under the Extended Arrangement Under the Extended Fund Facility, Request for Rephasing of Access, Waivers of Nonobservance of Performance Criteria, Modification of Performance Criteria and Financing Assurances Review-Press Release; Staff Report; and Statement by the Executive Director for Argentina (Country Report No. 2023/312).

- Li, Kun, and Hao Wei. (2023). “Yuan Meets All Criteria to Be a Cross-Border Trade Currency.” China Daily.

- McDowell, Daniel. (January 2019). “The (Ineffective) Financial Statecraft of China’s Bilateral Swap Agreements.” Development and Change, Vol. 50, No. 1.

- Nugent, Ciara. (August 2023). “Argentina’s far-right libertarian wants tougher austerity to rebuild troubled economy.” Financial Times

- Perez-Saiz, Hector, and Longmei Zhang. (2023). “Renminbi Usage in Cross-Border Payments: Regional Patterns and the Role of Swap Lines and Offshore Clearing Banks.” IMF Elibarary.

- United Nations COMTRADE database. (October 2023). Argentina Exports to China. Trading Economics.

- United Nations COMTRADE database. (October 2023). Ecuador Exports to China. Trading Economics.

- Schaefer Muñoz, Sara, and Ryan Dube. (2022). “Ecuador Reaches Deal With China to Restructure Debt.” The Wall Street Journal.

- Squires, Scott. (September 2022). ” Investors Dodge Argentina Bond Pain by Buying YPF, Provinces.” Bloomberg.

- The Economist. (2023). “Meet Javier Milei, the Front-runner to be Argentina’s Next President.”

- Tobias, Manuela, and Ignacio Olivera Doll. (2023). “Argentina’s Milei Wouldn’t Dollarize Overnight, Adviser Says.” Bloomberg.

- Tran, Hung. (2022). “Internationalization of the Renminbi via Bilateral Swap Lines.” The Atlantic Council.

- Xinhua News. (2018). “国务委员兼外交部长王毅谈习近平主席访问西班牙、阿根廷、巴拿马、葡萄牙并出席二十国集团领导人第十三次峰会” [Translation: ” State Councilor and Minister of Foreign Affairs Wang Yi Talks about President Xi Jinping’s Visit to Spain, Argentina, Panama, Portugal, and Attendance at the 13th G20 Summit”].

- Youkee, Mat. (November 2022). “China circles El Salvador’s economy as country edges toward crypto plunge.” The Guardian.

- Zhang, Ming. (2015). “Internationalization of the Renminbi.” Centre for International Governance Innovation. Report 2. New Thinking and the New G20 Series.

- 庞珣 (Pang Xun), and 陈冲 (Chen Chong). (2022). “国际金融的‘赫希曼效应’” [Translation: “The “Hirschman Effect” in International Finance”], Peking University Open Research Data Platform.

- 张策 (Zhang Ce), 何青(He Qing), 唐博文 (Tang Bowen). (September 2017). “RMB Currency Swap Agreements: Who Ultimately Benefits?—A Perspective Based on Bilateral Trade” [Translation: 人民币货币互换协议,谁最终获益?——基于双边贸易的视角]. China Finance 40 Forum Working Paper Series (中国金融四十人论坛工作论文系列), No. CF40WP2017021 (Issue 74).

Picture credits: Pixabay

Be First to Comment