This article is part of the report “Colombia’s Role Amid Great Power Competition“, published in September 2021 by Colombia Risk Analysis, and written in collaboration with Sergio Guzmán. Sergio is the Founder and Director of Colombia Risk Analysis, a political risk consultancy based in Bogotá. He is also an Adjunct Professor of Business at Universidad Externado de Colombia and a Columnist at The Bogota Post. A graduate in history and international affairs from The George Washington University, he holds a degree in international economics and international relations from The Johns Hopkins University – Paul H. Nitze School of Advanced International Studies (SAIS).

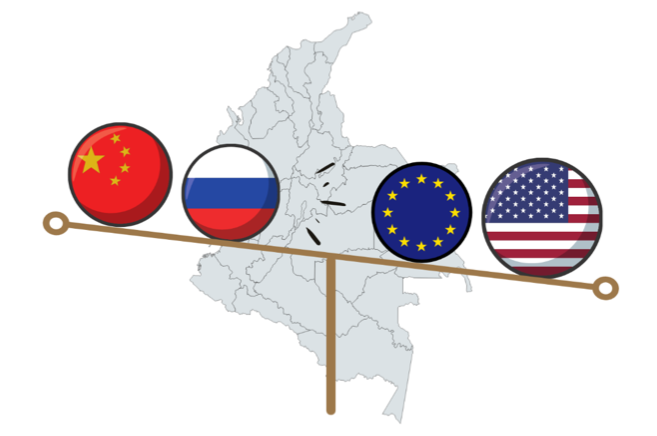

Colombia holds a unique position in the eyes of the world’s great powers. Due to geopolitical, economic, and strategic factors, Colombia has grabbed the attention of the United States, China, Russia, and the European Union, all having different interests and agendas in their relationships with the Andean country. While the United States has been Colombia’s largest trade partner for some time, other countries like the European Union and China are making headway in growing their economic and financial footprint in Colombia. Colombia has been a long-held US stronghold in Latin America, but that does not mean that the country is not looking to open avenues of trade and investment from competing powers.

The People’s Republic of China is making its presence and power well known throughout Latin America. The Asian superpower is using its comparative advantages and strategic planning to build strong economic and commercial relationships with some of the region’s biggest players. China and Colombia established a free trade agreement which was put into force in 2013, and China has become the second largest destination for Colombian exports and the second largest country of origin for imports into Colombia. Chinese demand for Colombian goods leans heavily on the country’s energy sector, where 86% of exports are crude petroleum. Chinese has also taken on major investment projects in Colombia, such as leading the construction of the long-awaited Bogotá metro, the RegioTram, as well as acquiring a gold mine in Antioquia.

China’s engagement in Colombia will likely stay largely commercial and economic, and like most countries in Latin America, Colombia will likely continue to court China in efforts of diversifying trade and investment. Additionally, it is important to note that when originally expanding its influence in Latin America, China had more success with countries that were more ideologically aligned. China’s policy of non-intervention in the domestic affairs of its trade partners also makes China less wary of political shifts or changes as a result of elections that are likely to dissuade other foreign investors. It also helps that China is not accountable domestically for its foreign entanglements or investments.

Colombia’s interest in attracting China means it will likely continue to foster engagement. Having a closer relationship with the economic superpower will be beneficial for Colombia, as it increases access to the country’s enormous market, increasing trade. Not only will this give Colombia the chance to expand the volume of trade, but also provide opportunities to diversify trade, providing more economic cushions for future shocks.

Additionally, getting closer to China will facilitate influxes of Chinese capital and knowledge exchanges that can be used to develop domestic industry. There will likely be continued dialogue on Colombia joining the Belt and Road Initiative (BRI). President Iván Duque expressed interest in joining the BRI on a trip to China, and could potentially achieve this through a decree before his term ends, however, Colombia’s relationship with the US will pose some challenges. Colombia’s entrenched relationship with the US makes it a less opportune country for China to do business, as it poses greater risks. China’s investment often seeks the path of least resistance, and the US’s strong and pervasive presence in the Andean country creates some resistance, especially for creating large agreements like having Colombia join the BRI.

With this opportunistic approach in mind, China’s investment will continue to lean on Colombia’s hydrocarbons and extractive industries, at least in the short-term, as those industries provide goods that meet China’s demand and already have a proven return on investment. Additionally, the Chinese Ministry of Commerce and Ministry of Ecology and Environment have released guidance to promote green development through the BRI. While not officially part of the BRI, it is likely that China will create competition with the US regarding development, financing, and procurement in Colombia’s green energy sector. This is likely to develop with solar energy, as Colombia has potential for a strong solar sector and as China produces 80% of solar panels globally.

The tension of maintaining good relationships with the US while courting Chinese investment will mean that the next Colombian executive will have to play a balancing act. The US will likely have a rapprochement with Colombia in the near future and will not favor China’s growing presence in its Latin American stronghold. For these reasons, Chinese projects and investments in Colombia will not reach the volume as some other Latin American states.

Colombia’s trade relationship with China is burgeoning, especially when compared to China’s engagement with the rest of Latin America. If it plays its cards right, Colombia can take advantage of the incipient relationship and China’s insatiable demand to advance its own economic goals. However, Colombia’s foreign policy has been largely reactive to the great powers rather than proactive. Strategic planning from the Colombian government is needed if it wishes to leverage these relationships for its own growth, but little has been seen in the national dialogue surrounding this issue. The planning must be thoughtful as not to cause waves in the relationships it already has, and lose out on any potential gains.

Picture credits: Colombia Risk Analysis

Be First to Comment